The wrong advisor can quietly cost you hundreds of thousands.

Even a 1% annual difference in fees or returns can cost over $240,000 in retirement value.

Part of The Evidence-Based Advisor Selection Series™

Why We Trust — and How It Costs Us.

Most investors rely on intuition or reputation when choosing an advisor.

Institutions don’t. They use measurable criteria, documented performance, and structured accountability — because experience has shown that trust alone is not a reliable safeguard.

Part of the Evidence-Based Advisor Selection Series™

The Hidden Cost of Misaligned Advice

Most investors assume poor performance is market-driven. In reality, it’s often incentive-driven.

When an advisor’s pay or product bias shapes their recommendations, you pay for it in lost returns, unnecessary fees, and missed opportunities.

Institutional investors demand alignment, transparency, and proof. You should too.

"It’s not about trusting more. It’s about verifying better."

The Cost of Blind Trust

Most investors never see the impact of under-performance and fees.

1% less return = roughly $240,000 lost over 20 years.

Assumes $1,000,000 portfolio, 20-year compounding, 8% vs 9% return.

Even a seemingly modest 1% annual difference in advisor costs can quietly erode more than $240,000 from a $1 million portfolio over 20 years.

"The wrong incentives compound losses the same way good investments compound gains."

Even small gaps compound quietly. The checklist reveals where they hide.

Meet The Institutional Insider

Paul Powell

Former Institutional Advisor | Managed $2B | Top 300 in Nation

Before founding Educated Investors, Paul Powell was one of the Top 300 financial advisors in the United States, managing over $2 billion in retirement plan assets for Fortune 500 companies.

After two decades in the institutional world, he saw a disturbing truth:

the same rigorous hiring standards used by major companies were never applied by individual investors.

So he built a system to fix that —

the Evidence-Based Hiring™ Framework.

“Institutions don’t hire on trust. They hire on proof.” — Paul Powell

The same framework Paul used to evaluate institutional managers overseeing billions.

Meet The Institutional Insider

Paul Powell

Former Institutional Advisor | Managed $2B | Top 300 in Nation

Before founding Educated Investors, Paul Powell was one of the Top 300 financial advisors in the United States, managing over $2 billion in retirement plan assets for Fortune 500 companies.

After two decades in the institutional world, he saw a disturbing truth:

the same rigorous hiring standards used by major companies were never applied by individual investors.

So he built a system to fix that —

the Evidence-Based Hiring™ Framework.

“Institutions don’t hire on trust. They hire on proof.” — Paul Powell

The same framework Paul used to evaluate institutional managers overseeing billions.

The Evidence-Based Hiring™ Framework helps investors make smarter, safer decisions when choosing a financial advisor.

The framework translates institutional due-diligence standards into a disciplined model any investor can apply when evaluating a financial advisor.

The Four Pillars of

Evidence-Based Hiring™

Expertise

Advisors should prove specialized skill in your area of need — retirement income, business exits, or tax strategy.

What this means for you: You’ll know your advisor is qualified for your situation, not just generally experienced.

Transparency

Every incentive, cost, and potential conflict must be visible in writing.

What this means for you: You’ll finally see how your advisor really gets paid — and whether their incentives align with yours.

Accountability

Advisors should agree to measurable benchmarks and written progress reports.

Alignment

Advisors should be compensated in ways that advance your interests — not their own.

What this means for you: You’ll know your advisor’s advice is guided by your goals, not by commissions, product sales, or asset-based fees.

Applied together, these dimensions replace the subjective question of who to trust with an empirical one: what does the evidence show?

The result is a shift from assumption to analysis—and from dependence on personality to confidence in process.

You can apply the same pillars institutions use —

this checklist shows how.

You can use the same three pillars institutions rely on. The checklist shows how.

From Trust to Proof

Clarity begins when advice is measured, not assumed. Institutions don’t rely on personality or referrals — they rely on evidence.

Most investors pick advisors based on personality or referrals.

Institutions don’t. They use data, incentives, and performance audits.

The Evidence-Based Hiring™ Framework brings that discipline to individuals — so you can choose an advisor with evidence, not emotion.

Institutions follow a process. Now individual investors can too.

The Six Steps of the Evidence-Based Hiring Method

The same due diligence process institutions use to vet asset managers — simplified for individuals.

1

Define Your Goal

Clarify what success looks like — retirement income, business exit, or growth target.

Every great decision starts with clarity.

2

Set Minimum Criteria

Decide your non-negotiables: fiduciary status, credentials, experience, AUM range.

You deserve proven expertise.

3

Conduct Due Diligence

Request documentation: Form ADV, fee schedule, regulatory filings, investment process.

Ask for data. Watch who hesitates.

4

Select Finalists to Interview

Compare how each advisor communicates, documents, and defends their strategy.

Good advisors welcome tough questions.

5

Negotiate a Fair Fee.

Choose a flat or fixed fee that rewards results — not asset size.

Incentives should serve you, not them.

6

Establish an Accountability Framework

Set measurable benchmarks and quarterly reviews.

Oversight turns promises into proof.

Institutions follow a process. Now individuals can too.

What the Data Shows

Independent studies continue to confirm what disciplined investors have known for years:

Transparency, accountability, and alignment drive better outcomes.

Investors who evaluate their advisors using objective criteria—fee structure, fiduciary status, and documented results—retain more wealth and experience greater long-term confidence in their plans.

Yet fewer than one in five investors ever ask for measurable proof.

The Evidence-Based Advisor Selection Series™ was created to change that—by helping individuals apply the same standards institutions have relied on for decades.

"The difference between hope and confidence is evidence."

Evidence isn’t opinion. It’s how disciplined investors make better decisions.

The Educated Investor Blog

Insights and analysis for investors who make decisions based on evidence, not persuasion.

Each article in the Educated Investor Blog examines the real-world forces that shape financial outcomes—how incentives work, where conflicts hide, and why transparency matters.

Our goal is to help investors think independently, evaluate advisors critically, and make decisions that stand up to evidence.

Three Questions to Ask a Financial Advisor About Fees, Incentives, and Conflicts of Interest

Most investors never see the full cost of financial advice, or how incentives shape recommendations. These three questions reveal your advisor’s compensation, potential conflicts, and whether their ... ...more

Advisor Selection ,Evidence-Based Investing

November 30, 2025•4 min read

Three Questions to Ask a Financial Advisor to Tell If You Can Trust Their Investment Process

Most advisors sound confident, but few follow a disciplined investment process. These three questions reveal whether your financial advisor uses written criteria, defines risk clearly, and accepts rea... ...more

Advisor Selection ,Evidence-Based Investing

November 29, 2025•5 min read

Three Questions to Ask a Financial Advisor to Tell If You Can Trust Their Advice

Learn how to identify a truly experienced financial advisor from a generalst. These three questions cut through jargon, appearance, and sales talk to reveal real advisory experience and accountability... ...more

Advisor Selection ,Evidence-Based Investing

November 29, 2025•4 min read

Three Questions That Reveal an Advisor’s Real Experience

Learn how to identify a truly experienced financial advisor. These three questions cut through jargon, appearance, and sales talk to reveal real advisory experience and accountability. Essential readi... ...more

Advisor Selection ,Evidence-Based Investing

November 29, 2025•7 min read

The One Thing Your Advisor Should Be Sending You Every Quarter (But Probably Isn’t)

Most investors never receive written proof of what their advisor actually did. Quarterly commentary and meeting minutes expose whether your advisor adds value or just checks in. Discover the instituti... ...more

Advisor Selection ,Evidence-Based Investing

November 29, 2025•5 min read

How Educated Investors Evaluate Financial Advisors

Learn how Educated Investors evaluate financial advisors using evidence, alignment, and written due diligence. This mindset reduces bias, improves clarity, and helps investors make confident, discipli... ...more

Advisor Selection ,Evidence-Based Investing

November 29, 2025•4 min read

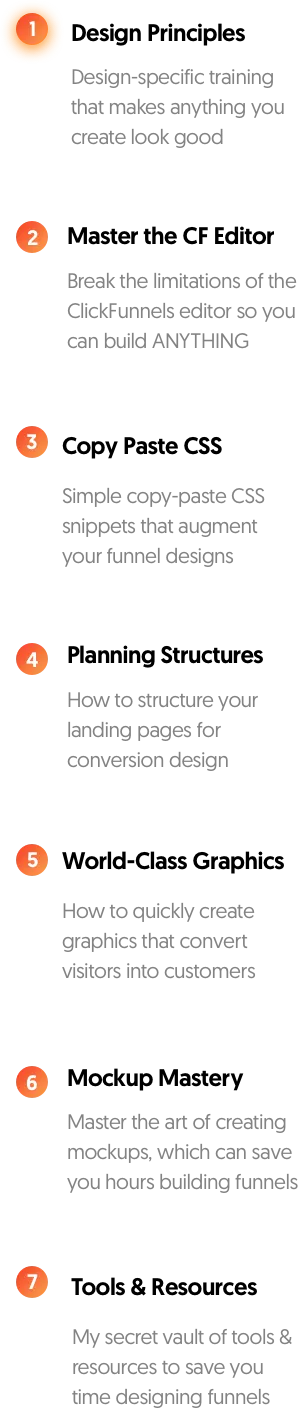

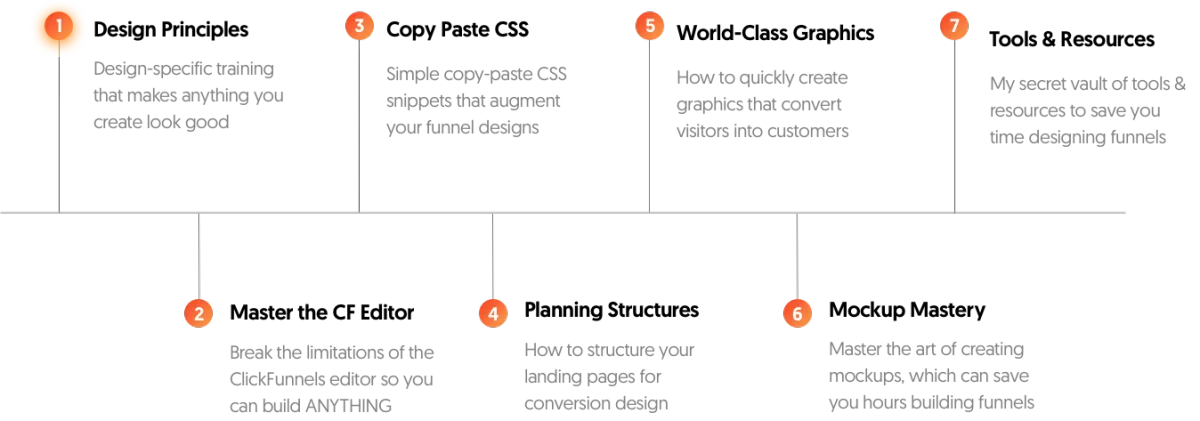

So.. what are you going to learn inside Funnel Designer Masterclass?

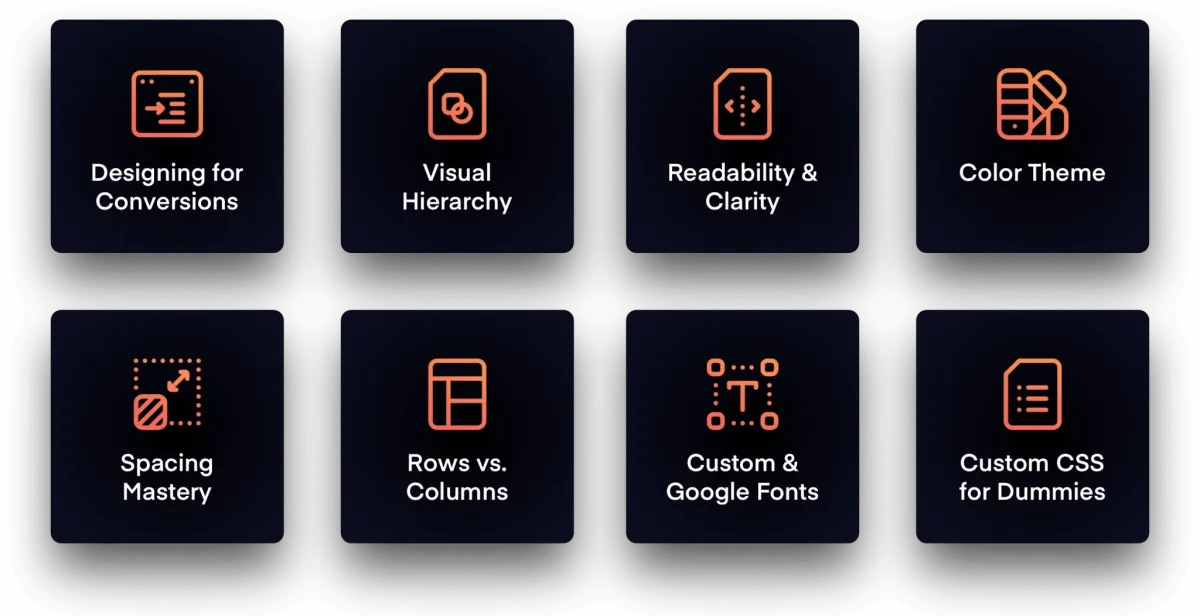

Preview a few lessons straight from the Masterclass:

Curious what the Funnel Designer Masterclass does for you?

Checkout our 7 Step Process to Turn Anyone into a Master Funnel Designer...

Not to mention...

And even things like Mastery of Sketch for Mockups, Creating Beautiful Graphics, and Much, Much, More.

You'll Also Get My 10x Funnel Templates Pack...

Shortcut Your Journey to Getting Your Next Client

- Create winning proposals in an instant. Import them into your Clickfunnels account with one click. Then customize the branding to match your target audience.

- Show up as an expert in new industries/niches. Attract your dream clients with 100% relevant funnels and industry-specific offers. Even if you’ve never worked in that industry before!

- Build killer funnels super-fast. Use the templates to outline the flow and sequence of your funnel. Customize the design while keeping the structure and conversion strategy in place.

-

And land more high-paying clients to help you 2x, 3x or 10x your monthly income…

Normally All Sold for: $2,970

Use the Before/After Slider to See the Difference

Imagine if you could do this on Clickfunnels...

Would you get paid more for your funnel designs?

The Funnel Designer Masterclass can help you truly master the art of funnel design (even if you're a beginner) so you can start charging more for your work and turning this into a wildly profitable funnel design business.

After taking and practicing the content inside of the masterclass, you should be able to take any landing page (or even an idea) and create a world-class landing page just like you see here in a matter of hours.

(I was paid $10,000 for this project.. The secrets to designing funnels worth 5 figures is inside the masterclass!)

So I have one question...

What's stopping you from becoming one of the best?

-

Back when my work was average, my life was pretty stagnant

-

I got paid only $500 for a funnel (and would take weeks to do it)

-

I was always itching for the next client to hire me to pay my bills

If you can relate, you know just how much it can suck when your work's "just average"

- You don't stand out from any other ClickFunnels Designers

- Potential clients almost always question your credibility.

- It can be hard to get $2k out of someone, let alone $10k

If you can relate, you know just how much it can suck when your work's "just average"

-

You don't stand out from any other ClickFunnels Designers

-

Potential clients almost always question your credibility.

- It can be hard to get $2k out of someone, let alone $10k

That's exactly why I created the masterclass...

To Help ClickFunnels Designers like YOU Become the BEST at What They Do

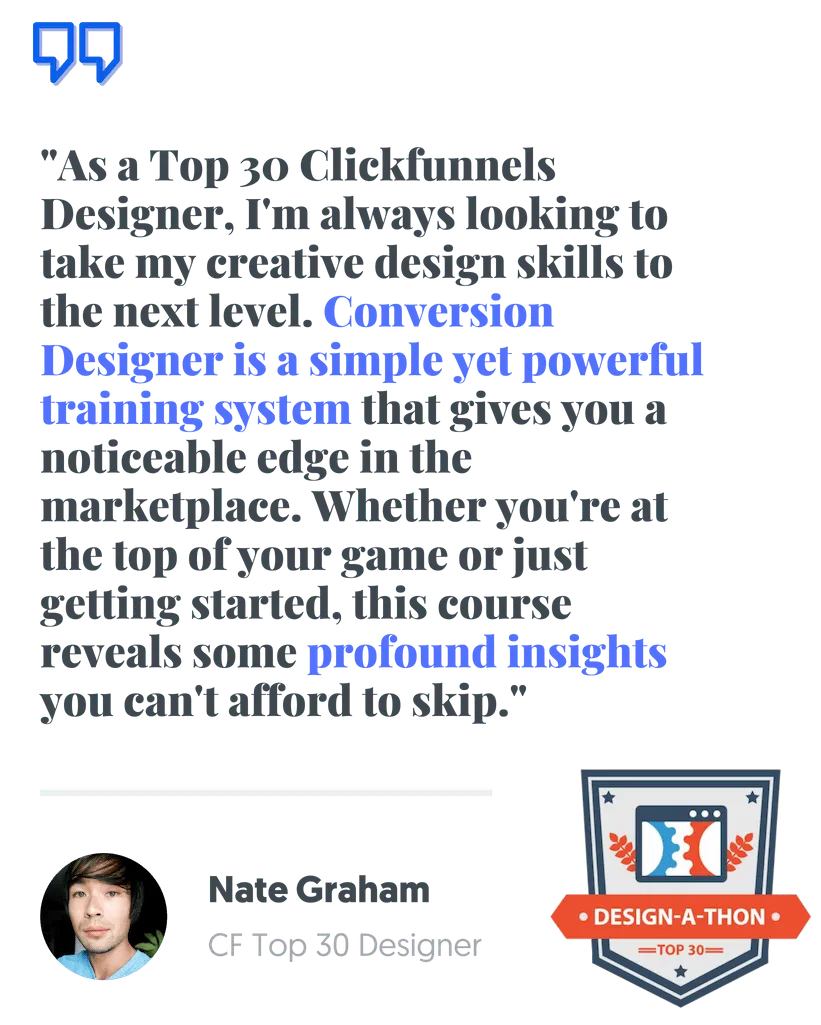

Need some proof?

See what Chris Gallardo, awarded the 2CC and 8 Figure Award by Russel Brunson, has to say:

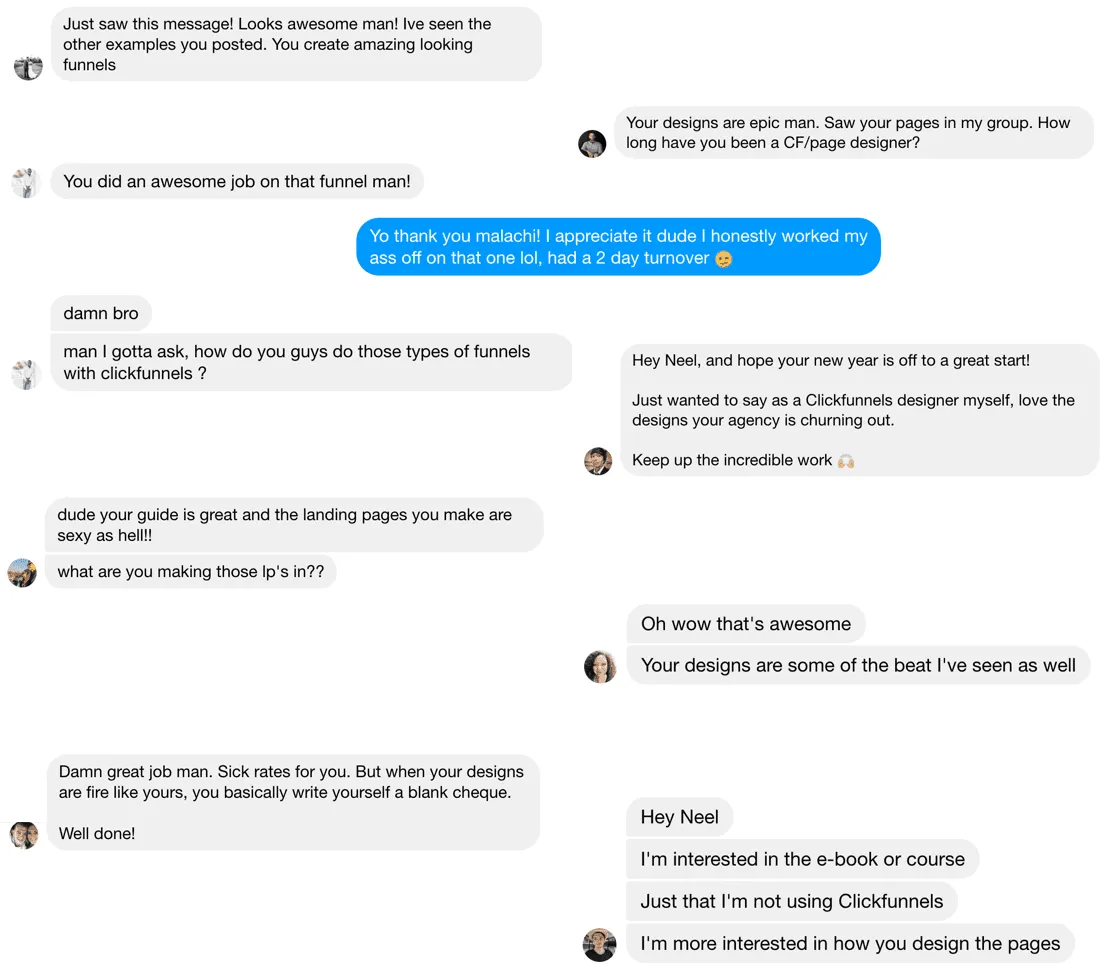

He's not the only one loving the Funnel Designer Masterclass...

I receive messages like this every single day...

What would it mean to you to have potential clients flooding your inbox every day with complements and requests to work with you?

- Learn how to design beautiful funnels that stand out from the rest

- Charge more for funnels & make more money as a designer

- Become more efficient and build funnels in half the time as usual

© 2023, Educated Investors. All rights reserved.

Contact us!